Blog

Long’uro: one elephant’s story of immense resilience

Read moreUnderstanding 2026 tax changes for donors

Plan ahead for smarter giving under the One Big Beautiful Bill Act (OBBB)

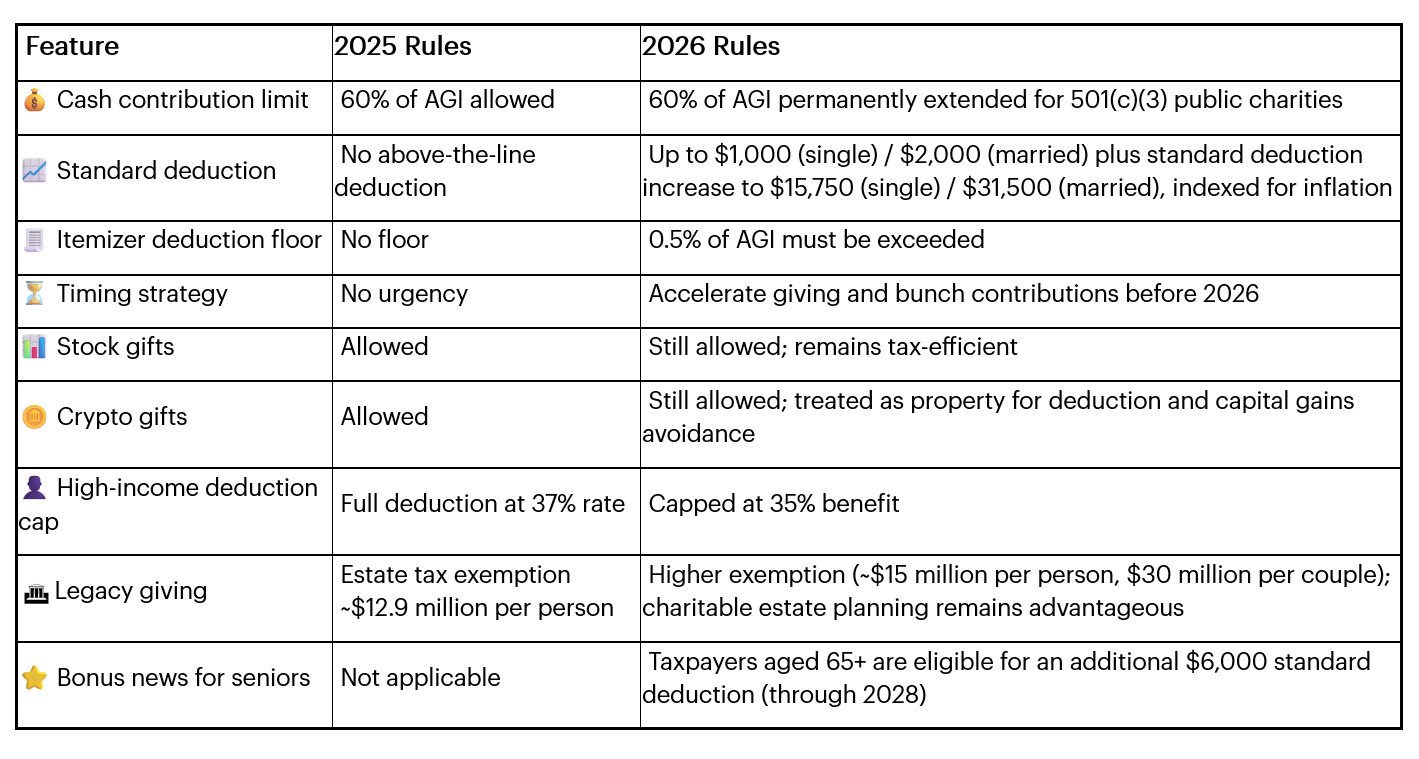

Charitable giving rules are changing under the One Big Beautiful Bill Act (OBBB) starting in 2026—but don’t worry, the changes are manageable and designed to keep strong incentives for giving. While the details may look complex, the impact for most donors is straightforward.

The key is timing: knowing what’s coming helps you plan ahead and make the most of your generosity. These updates apply to any charity you care about, so this is good information to have.

Highlights:

Generosity makes a difference—and these changes are here to keep charitable giving strong. With a little planning, you can continue to support the causes you care about while making the most of your tax benefits. Whether you give cash, stock, or crypto, use strategies like bunching, or want to update your will, the goal is simple: to help you give wisely and confidently.

“The Smartest Ways to Give at Year-End” is a video that you may find helpful. In it, FreeWill Co-CEO, Patrick Schmitt, interviews Dr. Russell James (a leading expert on charitable giving), about some of the smartest ways to give at year-end. It’s a quick watch, and it’s useful to inform your giving to any of the causes you care about.

For the first time since 2021, non-itemizers will get a tax break for charitable giving

We are happy to hear about your charitable plans and to support your philanthropic decisions. If you’re considering a gift or exploring options, please reach out to our team—we’re here to listen, share resources, and help you align your generosity with what matters most to you. We also welcome your donor stories—sharing what inspires you can help others see the impact of giving.

Email philanthropy@IFAW.org and we’ll put you in touch with a development staff person in your region.

Here’s a quick look at how upcoming tax changes could impact your charitable giving.

Disclaimer: This information is for educational purposes only and should not be considered tax or financial advice. Please consult with your own tax advisor or financial professional to determine how these rules apply to your individual situation.

Our work can’t get done without you. Please give what you can to help animals thrive.

Unfortunately, the browser you use is outdated and does not allow you to display the site correctly. Please install any of the modern browsers, for example:

Google Chrome Firefox Safari